IMPORTANT INFORMATION FOR YOU TO KNOW

Learn more about the changes in our FAQ.

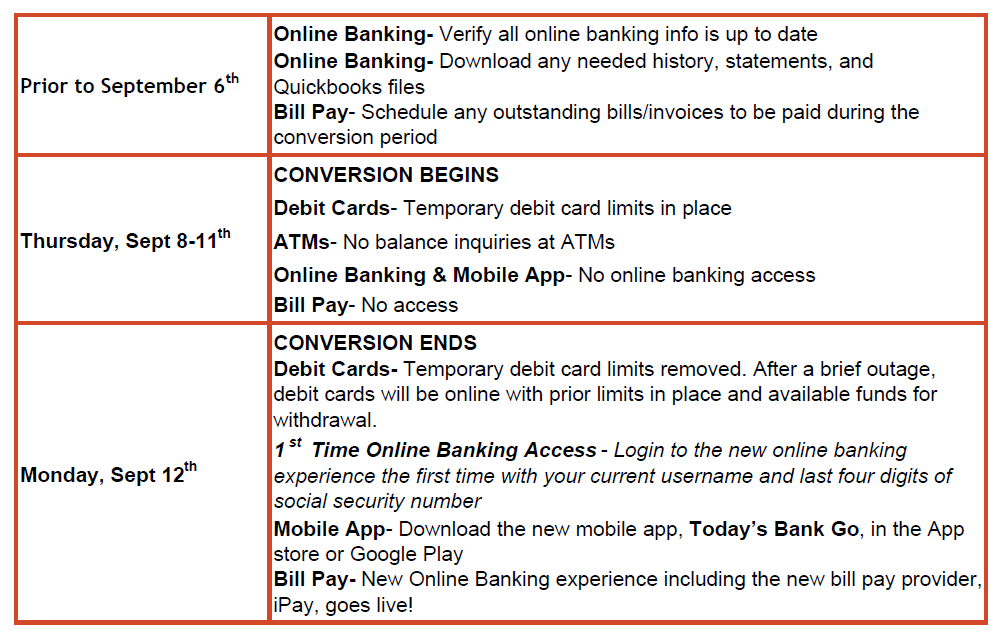

We are switching to a more powerful banking system that will benefit our customers in many ways by simplifying the process of day-to-day banking. While the existing banking system has served us well over the years, the newer, more flexible system is better equipped to serve you even better in the future. Please read the important information below that tells you what you can expect with the upgrade the week starting September 5, 2022.

DEBIT CARD & ATM ACCESS

Good news! You will keep the same debit card in your wallet and e-wallet through the upgrade. Unfortunately, the upgrade to our current banking system requires a maintenance period for your debit card.

There will be temporary debit card and ATM limits starting the evening of Thursday, September 8th, through Monday, September 12th. If your purchases exceed these temporary limits, you may need an alternative payment method during this period. Consider planning ahead and withdrawing any additional cash you might need by visiting an ATM or teller at a branch location during regular business hours. There will also be a brief outage period Monday before the upgrade is complete.

TRANSACTIONS AT THE BRANCH

All transactions transacted on Friday, September 9th, will be processed over the weekend. Saturday, September 10th, and Monday, September 11th, transactions will post Monday evening during normal processing. The branches will be open during normal business hours.

SPECIAL STATEMENT CYCLE

All customers will receive an account statement as of September 8, 2022, for any activity since your last statement (a “cutoff statement”). And this may result in some customers receiving two account statements for one cycle. One from the old system; and another for activity on the new system from go-live until your regular statement date on a new enhanced statement format.

PREPARATION FOR THE NEW ONLINE BANKING SYSTEM

To ensure a smooth start in our new Online Banking system, please take the following steps:

First, make sure we have your most recent contact information. We use this to set up your Secure Access Code. If we don’t have your correct contact information, you won’t be able to log in. Also, make note of any recurring transfer or Bill Pay information in your current account. These payments continue to process as normal through the transition, but it’s always smart to keep an eye out on the details. Finally, the new Online Banking experience requires the latest version of your preferred web browser to function at its best. Please note--your electronic statements will be available at a later time after conversion, so download and save any statements you might need before September 9th. If you forget, we can always help you get the information at any of our branches!

QUICKBOOKS USERS

A data file backup and a final transaction download will need to be completed BEFORE Friday, September 9th. Please make sure to complete the final download before this date since transaction history might not be available after the upgrade. On Monday, September 12th, you will complete the deactivate/reactivate of your online banking connection to ensure that you get your current QuickBooks accounts set up with the new connection. Check out more conversion instructions on our website, https://www.todaysbank.com/tools/banking-upgrade.

ONLINE BANKING OUTAGE

Your current Online Banking login will be active through Thursday, September 8th. ONLINE BANKING WILL BE UNAVAILABLE FOR MAINTENANCE AS WE CONVERT TO THE NEW SYSTEM FROM FRIDAY, SEPTEMBER 9TH THROUGH SUNDAY, SEPTEMBER 11TH. During this time, information about transactions and your balances will be available by calling any branch locations during business hours. Our new Online Banking experience including iPay is scheduled to go live the morning of September 12th!

BILL PAY OUTAGE

Bill Pay will have a scheduled outage period from September 6th through September 11th.

All outstanding bills need to be scheduled prior to September 6th to be paid before the new system activates on September 12th. The final payment date with our current vendor, Checkfree is September 12th, after that the scheduled payments will be paid with our new vendor, iPay. New Payment requests may not be scheduled September 6th through September 11th. Check out the demo with our new iPay provider.

Unfortunately, only six months of bill pay history will convert. So, if you need more history, be sure to download it before September 6th.

TRANSFERS

All your scheduled transfers, including external and internal, will also process as normal when we resume processing.

FIRST TIME LOGIN TO NEW ONLINE BANKING BEGINNING SEPTEMBER 12, 2022

If you prefer to use the app, make sure you download our new mobile app, Today’s Bank Go, from the App Store or Google Play. Previous versions of the Today’s Bank app will no longer function. If you’d like to login through the website, the link will be updated to take you to your new online banking login.

When you login for the first time, use your current username and last four digits of social security number.

You will be presented with a list of contact options to deliver your Secure Access Code. Once you receive the code, enter it in the provided field. The next steps are to update your password, accept the User Agreement, and select whether you’d like to register your device. Registering a device eliminates the need for a secure access code for future logins from that device.

As soon as you get into your Online Banking account, be sure to verify all your account, Bill Pay, and transfer information.

OVERDRAFT PROTECTION

The overdraft protection program is getting a new name. It will be called Bounce Protection. It has the same great overdraft features as our previous overdraft program, just a new name.

Please call (800)945-0073 during business hours if you need further assistance.